#27 Angelinvesting.it - From idea to Series A - Weekly Newsletter

VC Democratization: No thanks!!!

3 Minutes to reflect

When I hear crowdfunding platforms or startup founders telling me, 'we want to democratize access to the VC/startup asset class' it makes me cringe. They don't grasp how complicated this asset class is.

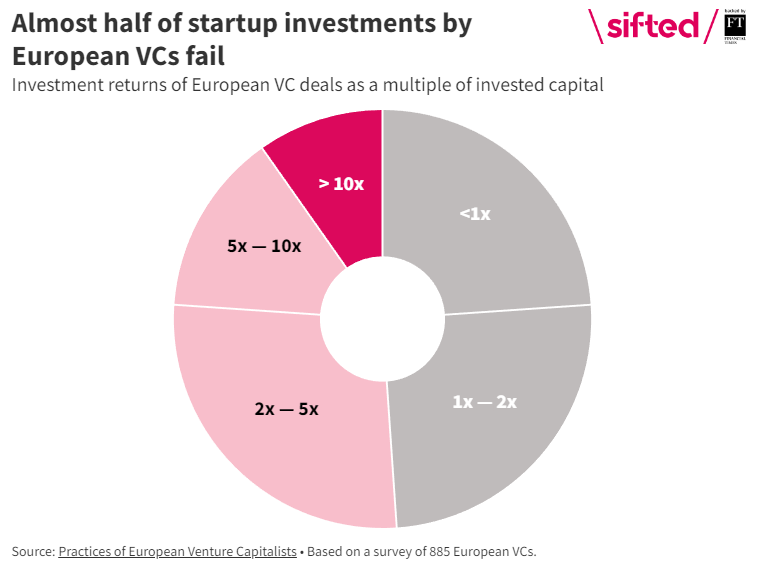

The largest limited partner in European VCs shared the fund's performance at a recent conference. After 10 years from the initial investment, the bottom 25% of his extensive portfolio didn't even return the money the fund had given them.

The middle half, positioned between the 25th and 75th percentiles, had mediocre returns. You would have been better off investing in an ETF that tracks an index. It would have had more liquidity and lower risk.

And then there are the stars. The top 25% performed well, averaging a 20% Internal Rate of Return (IRR), meaning they returned a significant multiple of the invested capital.

It's no surprise that among VC fund investors, there's a lot of talk about how to find these top performers. However, it's not an easy task. In that top 25%, as the manager explained, you have the names you would expect, the VC brands with a reputation, but also many outliers.

Even more controversial is that not all vintages of the same fund perform at the same level. Sometimes a mega brand in the fund launched in 2019 has a terrifying IRR, while the one launched in 2022 has inadequate returns.

To mitigate this risk, some investors prefer funds of funds to try to reduce the risk. However, the problem is that funds of funds often have mediocre results because they include both star funds and subpar ones. As a result, you end up with a not-so-brilliant average return. Additionally, there's the issue of facing a double layer of fees: those paid to the fund of funds manager and those paid to the managers of individual VC funds in the fund of funds' portfolio.

Not many institutional investors are fond of investing in VCs, and it's hard to blame them. Considering that VC funds lock your liquidity for 7-10 years, performance variance is substantial, fees are not low, and they are the only certain thing.

This asset class needs everything but democratization! It makes sense to have only a small portion of this asset class in a highly diversified portfolio.

2 Resources to pro level

Some interesting numbers about the European venture landscape. Link

The comprehensive study based on interviews with 883 European VCs at this link

1 Reason to be happy

The unwavering optimism of remarkable individuals remains undeterred by daunting numbers that might appear insurmountable. Encouragingly, here's a link to a list of 50 recently launched VCs in Europe. Stay determined and forge ahead

Have a great weekend,

Simone

—

Want to read more: click here

Want to invest with me: click here

Want to share a deck: click here