3 Minutes to reflect

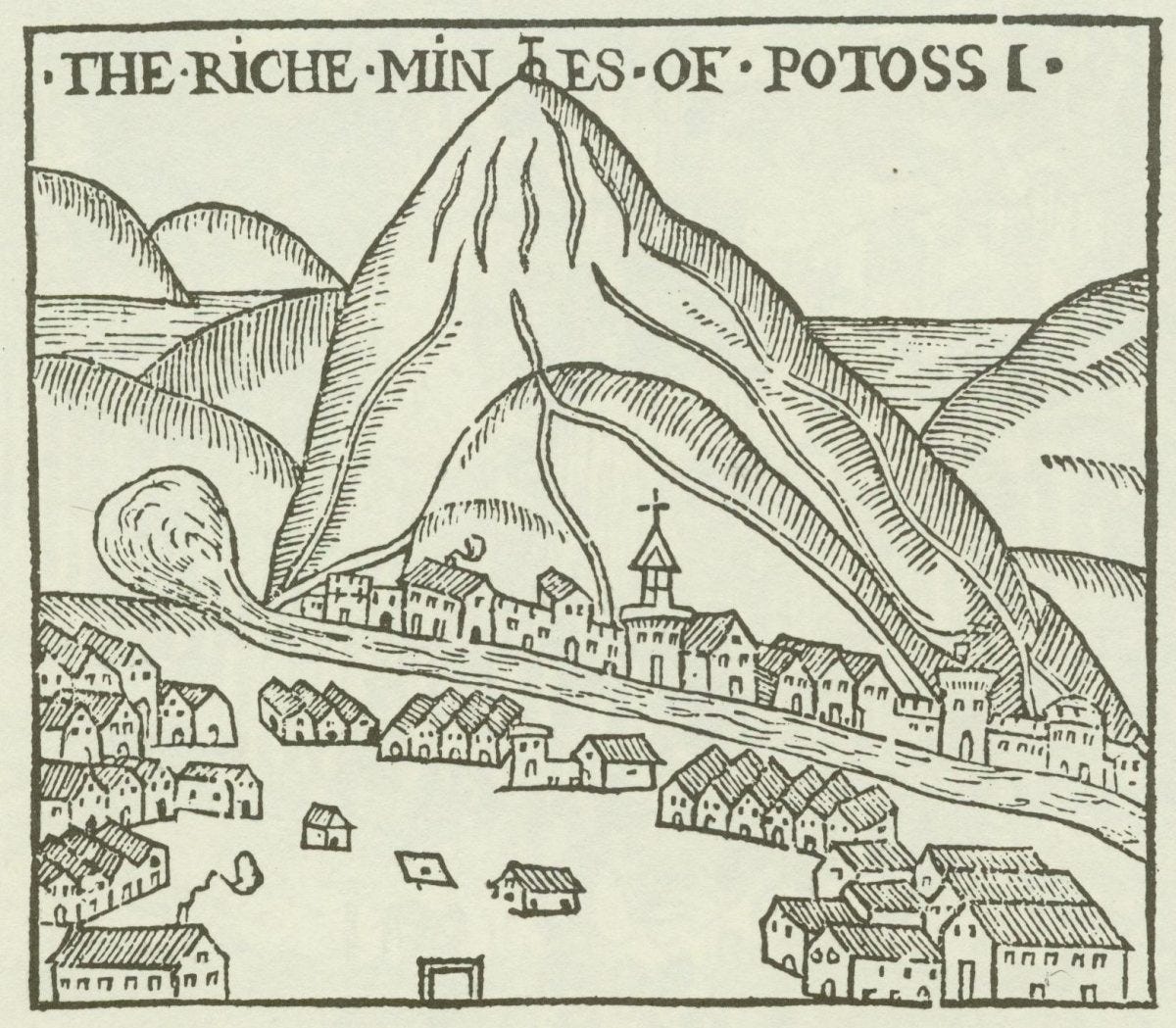

'Ceci n'est pas le Pérou' is a saying used in several languages as a reference to the successful Spanish exploration in South America. With the discovery and brutal conquest of Peru, the Spanish acquired silver from the Potosí mountain (now in Bolivian territory). The amount of wealth this mountain provided to Spain was so substantial that even today we refer to Peru as a place of riches.

In recent years, Nvidia seems to have found its own 'Potosí mountain,' as it was among the first to grasp the crucial role GPUs would play in the realm of AI. GPUs, akin to their more well-known cousins CPUs, are integrated circuits capable of data processing. Originally used for graphic applications and gaming, their ability to perform parallel calculations has made them the backbone of AI infrastructure.

Nvidia sells the H100 GPU for $25-30K, while the overall costs is $3K (including R&D and overheads). A staggering 830% net profit! These chips have been preordered until 2024, and if you were to buy one today, you'd receive it in about 20 months.

Nvidia is using funds generated from chip sales to invest in the best AI startups currently in the market. These startups naturally welcome the industry's leading infrastructure player as an investor, seeing it as a potential competitive advantage. Essentially, Nvidia becomes an equity partner in favorable deals, paying with the money it earns from selling the chips themselves.

However, as is often the case in the tech world, what is true today may not hold tomorrow. While today's chip infrastructures are advanced, they fall short compared to our benchmark of excellence: the human brain. Specifically, these chips consume a significant amount of energy, unlike our brain that is content with a sandwich for lunch.

Beyond the high energy consumption, we are approaching the limits of the famous Moore's Law, which states that the number of components in a circuit doubles every 18 months. This formulation from 1960 has held true for over fifty years, but we are now nearing physical limitations. The wavelength of electrons prevents us from going below 5 nanometers.

While Nvidia continues to amass wealth, akin to the Spanish kings of old, a multitude of startups are seeking the next big silver mountain. Explorers in this new technological frontier are focusing on two areas: neuromorphic circuits and quantum computing.

2 Resources to pro

Inspiration for this newsletter comes from Francesco at Runa Capital. Their investment approach, pragmatism, and forward thinking are mind-blowing. You can find a presentation produced by Runa at this link, explaining everything you need to know about the Quantum computing revolution!

Making money 101: Owning the supply!

There is no doubt that the most effective way to generate profits is by controlling the supply. Those who have lived through the Web 2.0 boom era will undoubtedly find parallels with Nvidia's approach in its startup investment strategy. This evokes the golden age of Google, when it invested in innovative startups that then reinvested a significant portion of the budget in Google advertising.

A similar example is that of Microsoft, which entered OpenAI as an infrastructure provider. The collaboration between Microsoft and OpenAI, which led to a considerable degree of control by Microsoft, is primarily based on cloud services offered through Azure.

1 Reason to be happy

During the Bill Gates era, Microsoft was, as well, quite aggressive in acquisitions, as The Simpsons episode reminds us.

Have a great weekend,

Simone

—

Want to read more: click here

Want to invest with me: click here

Want to share a deck: click here