#9 Angelinvesting.it - From idea to Series A - Weekly Newsletter

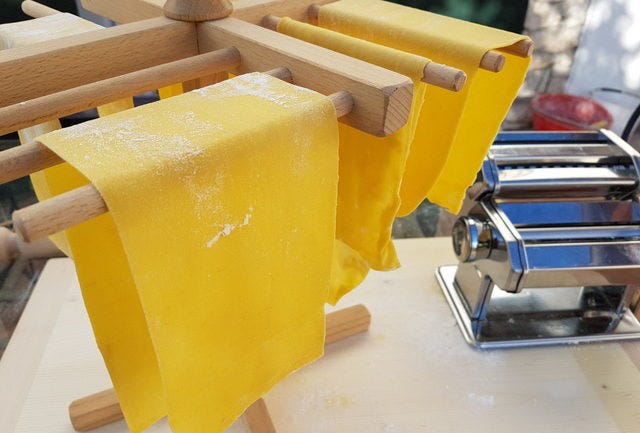

Fundraising and Lasagna

3 Minutes to reflect

Every family has a unique way of looking at the world, whether they put it into words or not. In my family, we understood that "more is better" without ever having to say it out loud.

One prime example of this philosophy was my mother's lasagna, which was always plentiful, expertly seasoned, and absolutely delicious. For her, showing love meant serving up heaping portions of lasagna - the more food on the table, the more love in the room.

When I approached iStarter's fundraising in 2019, I took this quantity-first approach with me and reached out to over 100 potential investors. I believed that the more investors I contacted, the better my chances of success. I was wrong, this approach proved to be counterproductive and did not yield the desired results.

Equity investment is a long-term commitment that requires mutual trust, and cultivating relationships is crucial in building that trust.

To my portfolio companies, I always give these three pieces of advice:

Start fundraising early when you have plenty of runway.

Be laser-focused on prioritizing a subset of ideal investors (ideally no more than 10-15).

Keep the communication going by sending an extra newsletter, a personalized update, or a WhatsApp message to the VC analyst.

Today, I miss my mother's lasagna and I treasure the lessons she taught me about generosity and abundance. Still, when it comes to personal relationships and business ventures, quality > quantity.

2 Resources to pro level

1 Crush Your First Investor Meeting: A Step-by-Step Guide to Ace It. Check it out!

Don't Miss Out on the Best CEO's Techniques to Make a Lasting Impression. GO!

2 How to cold reach out investors. A perfect template. Here you are!

1 Reason to be happy

AI is here! Say goodbye to boring PowerPoint presentations.

If you liked this newsletter, share it via mail to a friend or on your socials. It would mean a lot to me.

Have a great weekend,

Simone

—

Want to read more: click here

Want to invest with me: click here

Want to share a deck: click here