Buy assets and keep them for as long as you can.

#65 Angelinvesting.it - From idea to Series A - Weekly Newsletter

Dear reader,

On Tuesday there was quite a rare eclipse, according to experts. A very spiritual and perhaps very naive friend of mine recommended that I do a visualization exercise. "Write down what you want to achieve, the moon will be on your side." My policy on these superstitions is one of skepticism combined with pragmatism. I don't believe it, but I did the exercise anyway, just in case.

This is the vision of what I am trying to build distilled into 7 principles written on the back of a placemat from The IVY on High Street Kensington that I filled out while waiting for a couple of friends for dinner.

What I want to build (1-2-3)

An investment holding that buys private assets and holds them for as long as possible

The focus is on selecting entrepreneurs that I genuinely want to see succeed. Givers not takers. Principled, smart, and hard workers

My father had a mantra which was "buy and never sell." I must say that I have come to his conclusion. I added the nuance of "for as long as possible" because nothing is forever, but the time horizon I have in mind spans decades. A sort of perpetual capital unfettered by the needs of the next quarter or by the typical 7-year limits of private equity or VC funds.

How to manage the risk-reward profile (4-5)

I've talked about this in the newsletter, the barbell strategy. The idea of balancing with an 80/20 ratio of cash cows and moonshots.

A super useful tool for mapping the portfolio is the GROWTH / FCF matrix. The idea is to have 80% in high free cash flow and 20% in fast-growing projects. For more references on the Matrix and the 40% rule, see here.

How to make it happen (6-7)

The leadership I have in mind is based on 3 pillars: leading by example, clarity on what is a priority, and involving talent.

In the holding I envision, the priority is on the ability to generate free cash flow. I remember my father saying, "on one side only words, on the other the bottom line of the income statement." At this level of accountability, pragmatism, and intellectual honesty, I aim.

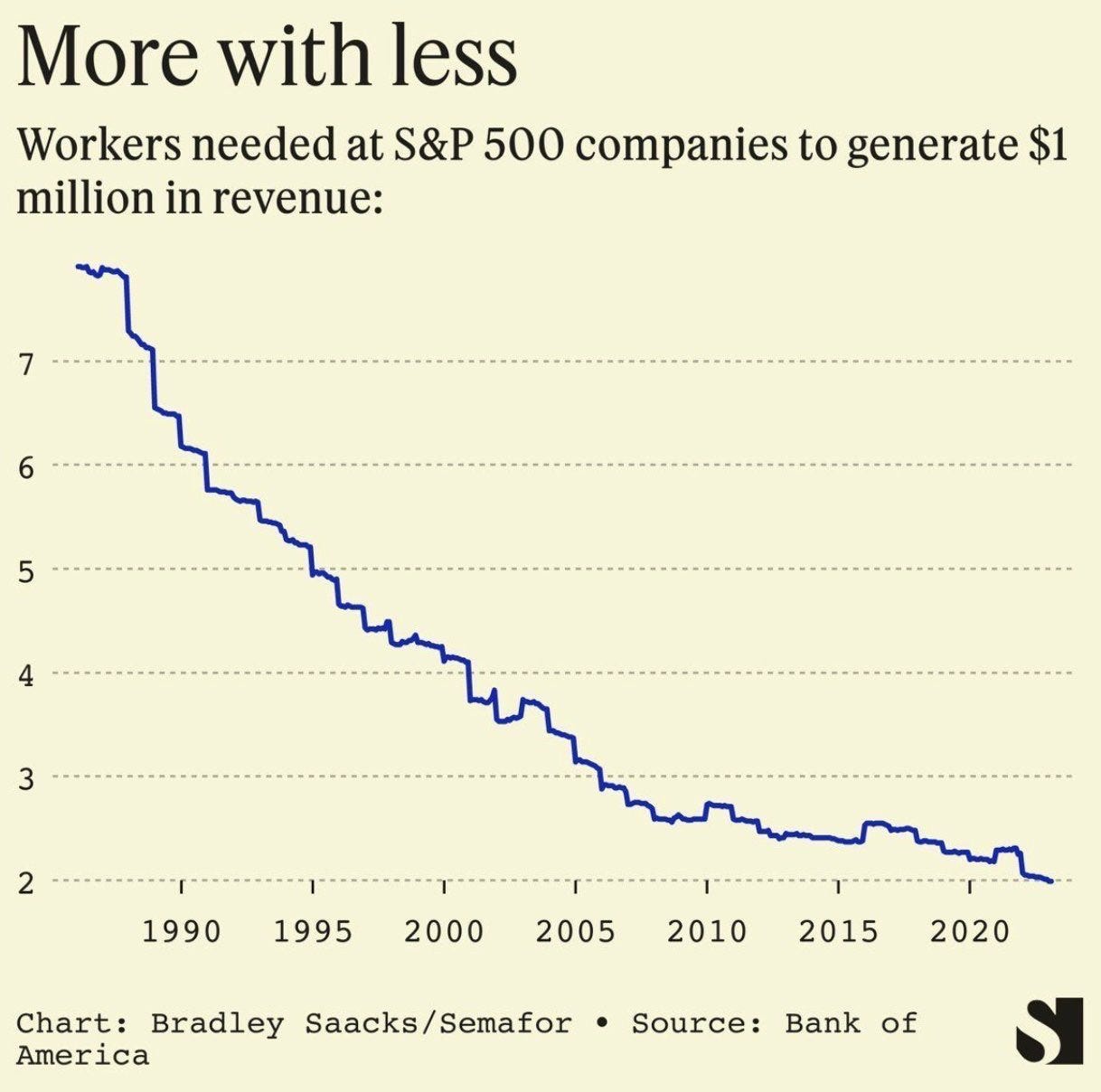

Lastly, on the team, we live in a world where the per capita revenue of the Fortune 500 is growing vertiginously. It is possible to do more and more with fewer and fewer people. I dream of a lean team of no more than 7 rockstars to make it happen.

Have a great weekend,

Simone

—

Want to read more: click here

Want to invest with me: click here

Want to share a deck: click here