The Anti-AI Investment Strategy That's Making Hedge Funds Millions

#109 Angelinvesting.it - From idea to Series A - Weekly Newsletter

Dear reader

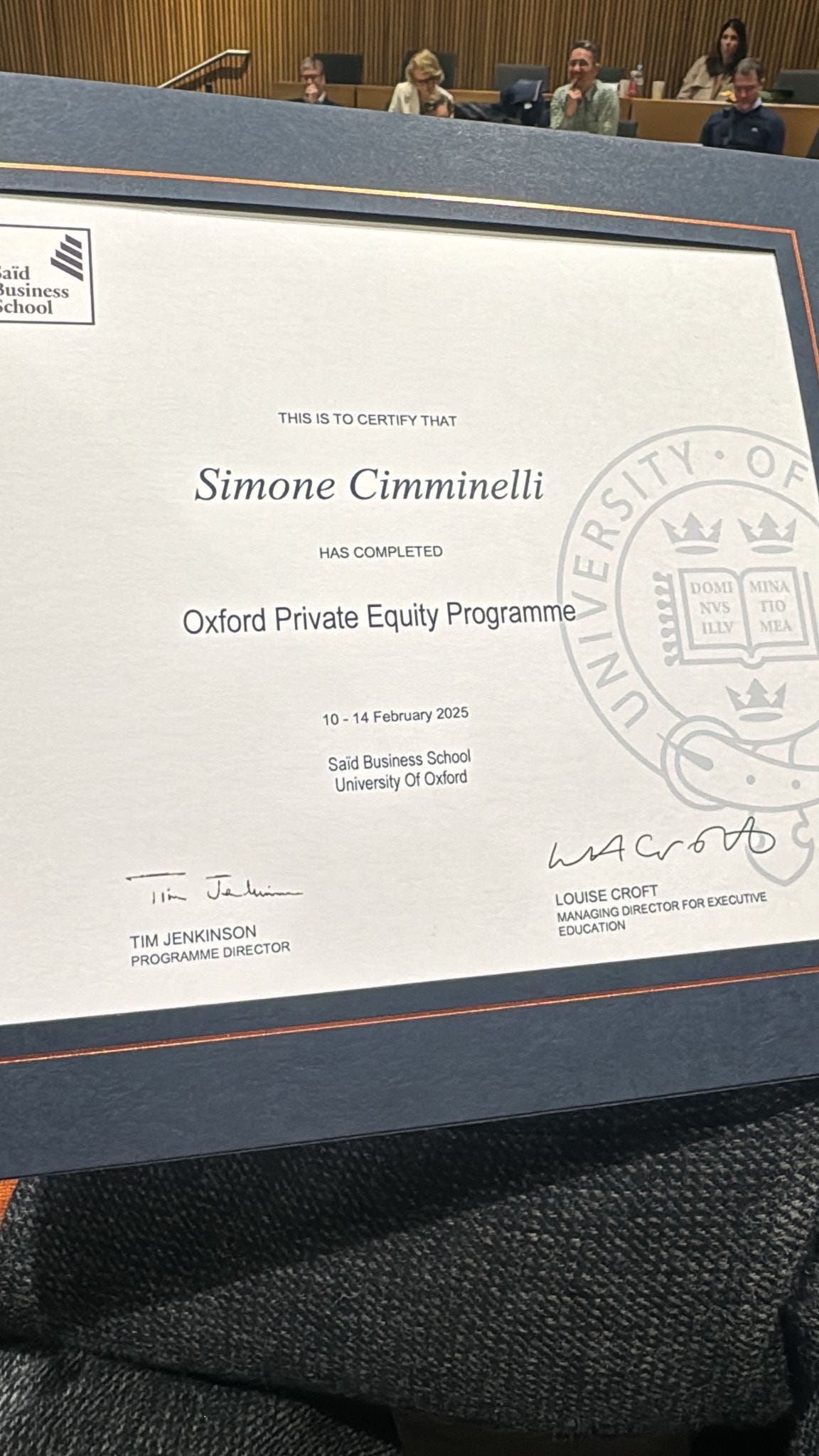

I hope you'll forgive me for a shorter than usual newsletter. I've been particularly busy in Oxford this week, immersed in a 5-day intensive course on private equity. I aim to share some insights in one of the next editions.

But don't worry - I won't leave you empty-handed. Instead, I'll share 3 contrarian ideas that have captured my attention, each supported by fascinating video content that I think you'll find valuable.

1. "The Big Short" Guys Think Brazil is Easy Money

Remember those investors who famously shorted the subprime mortgage market in 2007? They recently shared their latest money-making strategy at a Miami conference. While everyone else is caught up in AI fever and U.S. market optimism, they're looking elsewhere. Their thesis? You can buy great companies in Brazil, Europe, and China at P/E ratios of 6-7x compared to 40x in the U.S. (even higher for tech and AI companies).

2. Alibaba's CEO Thinks Silicon Valley is Wasting Money

While U.S. tech giants are in an AI arms race, spending billions on R&D and infrastructure, Alibaba's new CEO is taking a different approach. He suggests that much of this spending is wasteful and unlikely to deliver meaningful returns. Instead of pursuing the most powerful AI models at any cost, he advocates focusing on practical applications that solve real human problems.

3. JPMorgan's CEO Gets Real About Remote Work

A leaked audio recording of JPMorgan's CEO discussing remote work has been making waves. His unfiltered thoughts on efficiency, focus, and creativity offer a stark contrast to the prevailing narrative about the future of work. It's a refreshingly candid take on a controversial topic.

I'll be back next week with our regular format and more insights from my private equity deep dive.

Ciao, Ciao,

Simone

P.S. As always, I'd love to hear your thoughts on any of these contrarian views. Feel free to reach out.